1. INTRODUCTION

1.1. EXECUTIVE SUMMARY

1.2. ESTIMATION METHODOLOGY

2. MARKET OVERVIEW

2.1. AUTONOMOUS VEHICLE SENSOR MARKET: EVOLUTION & TRANSITION

2.2. MARKET DEFINITION & SCOPE

2.3. INDUSTRY STRUCTURE

2.4. REGULATORY FRAMEWORK

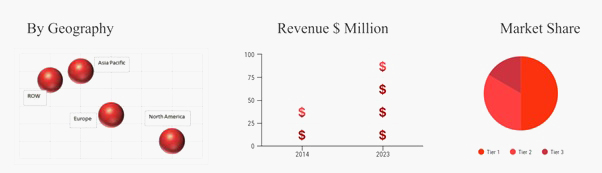

2.5. TOTAL MARKET ANALYSIS

2.5.1. TOP 5 FINDINGS

2.5.2. TOP 5 OPPORTUNITY MARKETS

2.5.3. TOP 5 COMPANIES

2.5.4. TOP 3 COMPETITIVE STRATEGIES

2.6. ESTIMATION ANALYSIS

2.7. STRATEGIC ANALYSIS

2.7.1. INVESTMENT VS. ADOPTION MODEL

2.7.2. 360-DEGREE INDUSTRY ANALYSIS

2.7.3. PORTERS 5 FORCE MODEL

2.7.4. SEE-SAW ANALYSIS

2.7.5. CONSUMER ANALYSIS AND KEY BUYING CRITERIA

2.8. COMPETITIVE ANALYSIS

2.8.1. KEY STRATEGIES & ANALYSIS

2.8.2. MARKET SHARE ANALYSIS AND TOP COMPANY ANALYSIS

2.9. STRATEGIC RECOMMENDATIONS & KEY CONCLUSIONS

2.9.1. INVESTMENT OPPORTUNITIES BY REGIONS

2.9.2. OPPORTUNITIES IN EMERGING APPLICATIONS

2.9.3. INVESTMENT OPPORTUNITY IN FASTEST GROWING SEGMENT

3. MARKET DETERMINANTS

3.1. MARKET DRIVERS

3.1.1. INCREASED NEED TO PREVENT ROAD ACCIDENTS

3.1.2. RISE IN ADOPTION OF CONNECTED CARS

3.1.3. INCREASING VEHICLE COMMUTING POPULATION

3.1.4. INCREASING TECHNOLOGICAL DEVELOPMENTS

3.1.5. INCREASING GOVERNMENT PROMOTIONS TO ADOPT LIDAR SENSORS

3.2. MARKET RESTRAINTS

3.2.1. HIGH VEHICLE AND INFRASTRUCTURE COST

3.2.2. SYSTEM MALFUNCTION

3.3. MARKET OPPORTUNITIES

3.3.1. ADVANCEMENTS IN LIDAR TECHNOLOGY

3.3.2. INCREASING ADOPTION IN ASIA PACIFIC REGION

3.4. MARKET CHALLENGES

3.4.1. LACK OF AWARENESS AMONG GENERAL POPULATION

4. MARKET SEGMENTATION

4.1. AUTONOMOUS VEHICLE SENSOR MARKET BY TYPE

4.1.1. MARKET DEFINITION AND SCOPE

4.1.2. DECISION SUPPORT DATABASE & ESTIMATION METHODOLOGY

4.1.3. COMPARATIVE ANALYSIS ACROSS MARKET SEGMENTS

4.1.4. OPPORTUNITY MATRIX

4.1.5. MARKET SEGMENTATION

4.1.5.1. GLOBAL CAMERA MODULE SENSOR MARKET

4.1.5.1.1. ADOPTION SCENARIO & MARKET DETERMINANTS

4.1.5.1.2. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.1.5.1.3. TOP PLAYERS & KEY PRODUCTS

4.1.5.1.4. KEY CONCLUSIONS

4.1.5.2. GLOBAL DIGITALLY CONTROLLED BRAKE, THROTTLE, STEERING SENSOR MARKET

4.1.5.2.1. ADOPTION SCENARIO & MARKET DETERMINANTS

4.1.5.2.2. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.1.5.2.3. TOP PLAYERS & KEY PRODUCTS

4.1.5.2.4. KEY CONCLUSIONS

4.1.5.3. GLOBAL GPS RECEIVER MARKET

4.1.5.3.1. APPLICATION

4.1.5.3.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.1.5.3.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.1.5.3.4. TOP PLAYERS & KEY PRODUCTS

4.1.5.3.5. KEY CONCLUSIONS

4.1.5.4. GLOBAL IMU SENSOR MARKET

4.1.5.4.1. APPLICATION

4.1.5.4.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.1.5.4.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.1.5.4.4. TOP PLAYERS & KEY PRODUCTS

4.1.5.4.5. KEY CONCLUSIONS

4.1.5.5. GLOBAL LIDAR SENSOR MARKET

4.1.5.5.1. APPLICATION

4.1.5.5.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.1.5.5.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.1.5.5.4. TOP PLAYERS & KEY PRODUCTS

4.1.5.5.5. KEY CONCLUSIONS

4.1.5.6. GLOBAL RADAR SENSOR MARKET

4.1.5.6.1. APPLICATION

4.1.5.6.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.1.5.6.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.1.5.6.4. TOP PLAYERS & KEY PRODUCTS

4.1.5.6.5. KEY CONCLUSIONS

4.1.5.7. GLOBAL ULTRASONIC SENSOR MARKET

4.1.5.7.1. APPLICATION

4.1.5.7.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.1.5.7.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.1.5.7.4. TOP PLAYERS & KEY PRODUCTS

4.1.5.7.5. KEY CONCLUSIONS

4.1.5.8. GLOBAL WHEEL ENCODER MARKET

4.1.5.8.1. APPLICATION

4.1.5.8.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.1.5.8.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.1.5.8.4. TOP PLAYERS & KEY PRODUCTS

4.1.5.8.5. KEY CONCLUSIONS

4.2. AUTONOMOUS VEHICLE SENSOR MARKET BY COMPONENT

4.2.1. MARKET DEFINITION AND SCOPE

4.2.2. DECISION SUPPORT DATABASE & ESTIMATION METHODOLOGY

4.2.3. COMPARATIVE ANALYSIS ACROSS MARKET SEGMENTS

4.2.4. OPPORTUNITY MATRIX

4.2.5. MARKET SEGMENTATION

4.2.5.1. GLOBAL CAPACITIVE MARKET

4.2.5.1.1. APPLICATION

4.2.5.1.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.2.5.1.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.2.5.1.4. TOP PLAYERS & KEY PRODUCTS

4.2.5.1.5. KEY CONCLUSIONS

4.2.5.2. GLOBAL INDUCTIVE MARKET

4.2.5.2.1. APPLICATION

4.2.5.2.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.2.5.2.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.2.5.2.4. TOP PLAYERS & KEY PRODUCTS

4.2.5.2.5. KEY CONCLUSIONS

4.2.5.3. GLOBAL MAGNETIC MARKET

4.2.5.3.1. APPLICATION

4.2.5.3.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.2.5.3.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.2.5.3.4. TOP PLAYERS & KEY PRODUCTS

4.2.5.3.5. KEY CONCLUSIONS

4.2.5.4. GLOBAL OPTICAL MARKET

4.2.5.4.1. APPLICATION

4.2.5.4.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.2.5.4.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.2.5.4.4. TOP PLAYERS & KEY PRODUCTS

4.2.5.4.5. KEY CONCLUSIONS

4.2.5.5. GLOBAL PIEZOELECTRIC MARKET

4.2.5.5.1. APPLICATION

4.2.5.5.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.2.5.5.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.2.5.5.4. TOP PLAYERS & KEY PRODUCTS

4.2.5.5.5. KEY CONCLUSIONS

4.3. AUTONOMOUS VEHICLE SENSOR MARKET BY APPLICATION

4.3.1. MARKET DEFINITION AND SCOPE

4.3.2. DECISION SUPPORT DATABASE & ESTIMATION METHODOLOGY

4.3.3. COMPARATIVE ANALYSIS ACROSS MARKET SEGMENTS

4.3.4. OPPORTUNITY MATRIX

4.3.5. MARKET SEGMENTATION

4.3.5.1. GLOBAL CHASSIS MARKET

4.3.5.1.1. APPLICATION

4.3.5.1.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.3.5.1.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.3.5.1.4. TOP PLAYERS & KEY PRODUCTS

4.3.5.1.5. KEY CONCLUSIONS

4.3.5.2. GLOBAL ENGINE MARKET

4.3.5.2.1. APPLICATION

4.3.5.2.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.3.5.2.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.3.5.2.4. TOP PLAYERS & KEY PRODUCTS

4.3.5.2.5. KEY CONCLUSIONS

4.3.5.3. GLOBAL FUEL INJECTION AND EMISSION MARKET

4.3.5.3.1. APPLICATION

4.3.5.3.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.3.5.3.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.3.5.3.4. TOP PLAYERS & KEY PRODUCTS

4.3.5.3.5. KEY CONCLUSIONS

4.3.5.4. GLOBAL POWER TRAIN MARKET

4.3.5.4.1. APPLICATION

4.3.5.4.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.3.5.4.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.3.5.4.4. TOP PLAYERS & KEY PRODUCTS

4.3.5.4.5. KEY CONCLUSIONS

4.3.5.5. GLOBAL SAFETY AND CONTROL MARKET

4.3.5.5.1. APPLICATION

4.3.5.5.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.3.5.5.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.3.5.5.4. TOP PLAYERS & KEY PRODUCTS

4.3.5.5.5. KEY CONCLUSIONS

4.3.5.6. GLOBAL TELEMATICS MARKET

4.3.5.6.1. APPLICATION

4.3.5.6.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.3.5.6.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.3.5.6.4. TOP PLAYERS & KEY PRODUCTS

4.3.5.6.5. KEY CONCLUSIONS

4.3.5.7. GLOBAL VEHICLE SECURITY MARKET

4.3.5.7.1. APPLICATION

4.3.5.7.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.3.5.7.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.3.5.7.4. TOP PLAYERS & KEY PRODUCTS

4.3.5.7.5. KEY CONCLUSIONS

4.3.5.8. GLOBAL OTHERS MARKET

4.3.5.8.1. APPLICATION

4.3.5.8.2. ADOPTION SCENARIO & MARKET DETERMINANTS

4.3.5.8.3. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

4.3.5.8.4. TOP PLAYERS & KEY PRODUCTS

4.3.5.8.5. KEY CONCLUSIONS

5. COMPETITIVE LANDSCAPE

5.1. KEY STRATEGIES

5.1.1. LIST OF MERGERS AND ACQUISITION

5.1.2. LIST OF JOINT VENTURES

5.1.3. LIST OF PRODUCT LAUNCHES

5.1.4. LIST OF PARTNERSHIPS

6. GEOGRAPHICAL ANALYSIS

6.1. DECISION SUPPORT DATABASE & ESTIMATION METHODOLOGY

6.2. COMPARATIVE ANALYSIS ACROSS MARKET SEGMENTS

6.3. OPPORTUNITY MATRIX

6.4. GLOBAL AUTONOMOUS VEHICLE SENSOR MARKET BY REGION 2014-2023 ($ MILLION)

6.4.1. NORTH AMERICA

6.4.1.1. INDUSTRY ANALYSIS 2014-2023 ($ MILLION)

6.4.1.2. TOP COUNTRY ANALYSIS

6.4.1.2.1. U.S.

6.4.1.2.1.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.1.2.1.2. TOP PLAYERS & KEY PRODUCTS

6.4.1.2.1.3. KEY CONCLUSIONS

6.4.1.2.2. CANADA

6.4.1.2.2.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.1.2.2.2. TOP PLAYERS & KEY PRODUCTS

6.4.1.2.2.3. KEY CONCLUSIONS

6.4.2. EUROPE

6.4.2.1. INDUSTRY ANALYSIS 2014-2023 ($ MILLION)

6.4.2.2. TOP COUNTRY ANALYSIS

6.4.2.2.1. UK

6.4.2.2.1.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.2.2.1.2. TOP PLAYERS & KEY PRODUCTS

6.4.2.2.1.3. KEY CONCLUSIONS

6.4.2.2.2. FRANCE

6.4.2.2.2.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.2.2.2.2. TOP PLAYERS & KEY PRODUCTS

6.4.2.2.2.3. KEY CONCLUSIONS

6.4.2.2.3. GERMANY

6.4.2.2.3.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.2.2.3.2. TOP PLAYERS & KEY PRODUCTS

6.4.2.2.3.3. KEY CONCLUSIONS

6.4.2.2.4. SPAIN

6.4.2.2.4.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.2.2.4.2. TOP PLAYERS & KEY PRODUCTS

6.4.2.2.4.3. KEY CONCLUSIONS

6.4.2.2.5. REST OF EUROPE

6.4.2.2.5.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.2.2.5.2. TOP PLAYERS & KEY PRODUCTS

6.4.2.2.5.3. KEY CONCLUSIONS

6.4.3. ASIA PACIFIC

6.4.3.1. INDUSTRY ANALYSIS 2014-2023 ($ MILLION)

6.4.3.2. TOP COUNTRY ANALYSIS

6.4.3.2.1. CHINA

6.4.3.2.1.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.3.2.1.2. TOP PLAYERS & KEY PRODUCTS

6.4.3.2.1.3. KEY CONCLUSIONS

6.4.3.2.2. INDIA

6.4.3.2.2.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.3.2.2.2. TOP PLAYERS & KEY PRODUCTS

6.4.3.2.2.3. KEY CONCLUSIONS

6.4.3.2.3. JAPAN

6.4.3.2.3.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.3.2.3.2. TOP PLAYERS & KEY PRODUCTS

6.4.3.2.3.3. KEY CONCLUSIONS

6.4.3.2.4. AUSTRALIA

6.4.3.2.4.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.3.2.4.2. TOP PLAYERS & KEY PRODUCTS

6.4.3.2.4.3. KEY CONCLUSIONS

6.4.3.2.5. REST OF ASIA PACIFIC

6.4.3.2.5.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.3.2.5.2. TOP PLAYERS & KEY PRODUCTS

6.4.3.2.5.3. KEY CONCLUSIONS

6.4.4. ROW

6.4.4.1. INDUSTRY ANALYSIS 2014-2023 ($ MILLION)

6.4.4.2. TOP COUNTRY ANALYSIS

6.4.4.2.1. LATIN AMERICA

6.4.4.2.1.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.4.2.1.2. TOP PLAYERS & KEY PRODUCTS

6.4.4.2.1.3. KEY CONCLUSIONS

6.4.4.2.2. MIDDLE EAST & AFRICA

6.4.4.2.2.1. MARKET ESTIMATIONS AND FORECASTS 2014-2023 ($ MILLION)

6.4.4.2.2.2. TOP PLAYERS & KEY PRODUCTS

6.4.4.2.2.3. KEY CONCLUSIONS

7. COMPANY PROFILES

7.1. CONTINENTAL AG (GERMANY)

7.1.1. OVERVIEW

7.1.2. PRODUCT PORTFOLIO

7.1.3. KEY INNOVATION SECTOR

7.1.4. STRATEGIC INITIATIVES

7.1.5. SCOT ANALYSIS

7.1.6. STRATEGIC ANALYSIS

7.2. TELE TRACKING TECHNOLOGIES INC. (U.S.)

7.2.1. OVERVIEW

7.2.2. PRODUCT PORTFOLIO

7.2.3. KEY INNOVATION SECTOR

7.2.4. STRATEGIC INITIATIVES

7.2.5. SCOT ANALYSIS

7.2.6. STRATEGIC ANALYSIS

7.3. DELPHI AUTOMOTIVE (U.K.)

7.3.1. OVERVIEW

7.3.2. PRODUCT PORTFOLIO

7.3.3. KEY INNOVATION SECTOR

7.3.4. STRATEGIC INITIATIVES

7.3.5. SCOT ANALYSIS

7.3.6. STRATEGIC ANALYSIS

7.4. DENSO (JAPAN)

7.4.1. OVERVIEW

7.4.2. PRODUCT PORTFOLIO

7.4.3. KEY INNOVATION SECTOR

7.4.4. STRATEGIC INITIATIVES

7.4.5. SCOT ANALYSIS

7.4.6. STRATEGIC ANALYSIS

7.5. NXP SEMICONDUCTORS (NETHERLANDS)

7.5.1. OVERVIEW

7.5.2. PRODUCT PORTFOLIO

7.5.3. KEY INNOVATION SECTOR

7.5.4. STRATEGIC INITIATIVES

7.5.5. SCOT ANALYSIS

7.5.6. STRATEGIC ANALYSIS

7.6. ROBERT BOSCH GMBH (GERMANY)

7.6.1. OVERVIEW

7.6.2. PRODUCT PORTFOLIO

7.6.3. KEY INNOVATION SECTOR

7.6.4. STRATEGIC INITIATIVES

7.6.5. SCOT ANALYSIS

7.6.6. STRATEGIC ANALYSIS

7.7. VALEO (FRANCE)

7.7.1. OVERVIEW

7.7.2. PRODUCT PORTFOLIO

7.7.3. KEY INNOVATION SECTOR

7.7.4. STRATEGIC INITIATIVES

7.7.5. SCOT ANALYSIS

7.7.6. STRATEGIC ANALYSIS

7.8. ASAHI KASEI (JAPAN)

7.8.1. OVERVIEW

7.8.2. PRODUCT PORTFOLIO

7.8.3. KEY INNOVATION SECTOR

7.8.4. STRATEGIC INITIATIVES

7.8.5. SCOT ANALYSIS

7.8.6. STRATEGIC ANALYSIS

7.9. BRIGADE ELECTRONIKS (U.K.)

7.9.1. OVERVIEW

7.9.2. PRODUCT PORTFOLIO

7.9.3. KEY INNOVATION SECTOR

7.9.4. STRATEGIC INITIATIVES

7.9.5. SCOT ANALYSIS

7.9.6. STRATEGIC ANALYSIS

7.10. FIRST SENSOR AG (GERMANY)

7.10.1. OVERVIEW

7.10.2. PRODUCT PORTFOLIO

7.10.3. KEY INNOVATION SECTOR

7.10.4. STRATEGIC INITIATIVES

7.10.5. SCOT ANALYSIS

7.10.6. STRATEGIC ANALYSIS

7.11. FUJITSU TEN (JAPAN)

7.11.1. OVERVIEW

7.11.2. PRODUCT PORTFOLIO

7.11.3. KEY INNOVATION SECTOR

7.11.4. STRATEGIC INITIATIVES

7.11.5. SCOT ANALYSIS

7.11.6. STRATEGIC ANALYSIS

7.12. NOVARIANT (U.S.)

7.12.1. OVERVIEW

7.12.2. PRODUCT PORTFOLIO

7.12.3. KEY INNOVATION SECTOR

7.12.4. STRATEGIC INITIATIVES

7.12.5. SCOT ANALYSIS

7.12.6. STRATEGIC ANALYSIS

7.13. TELEDYNE OPTECH (CANADA)

7.13.1. OVERVIEW

7.13.2. PRODUCT PORTFOLIO

7.13.3. KEY INNOVATION SECTOR

7.13.4. STRATEGIC INITIATIVES

7.13.5. SCOT ANALYSIS

7.13.6. STRATEGIC ANALYSIS

7.14. TRILUMINA (U.S.)

7.14.1. OVERVIEW

7.14.2. PRODUCT PORTFOLIO

7.14.3. KEY INNOVATION SECTOR

7.14.4. STRATEGIC INITIATIVES

7.14.5. SCOT ANALYSIS

7.14.6. STRATEGIC ANALYSIS

7.15. INFINEON TECHNOLOGIES (GERMANY)

7.15.1. OVERVIEW

7.15.2. PRODUCT PORTFOLIO

7.15.3. KEY INNOVATION SECTOR

7.15.4. STRATEGIC INITIATIVES

7.15.5. SCOT ANALYSIS

7.15.6. STRATEGIC ANALYSIS

LIST OF TABLES

1. GLOBAL AUTONOMOUS VEHICLE SENSOR MARKET BY TYPE 2014-2023 ($ MILLION)

2. GLOBAL CAMERA MODULE SENSOR MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

3. GLOBAL DIGITALLY CONTROLLED BRAKE, THROTTLE, STEERING SENSOR MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

4. GLOBAL GPS RECEIVER MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

5. GLOBAL IMU SENSOR MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

6. GLOBAL LIDAR SENSOR MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

7. GLOBAL RADAR SENSOR MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

8. GLOBAL ULTRASONIC SENSOR MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

9. GLOBAL WHEEL ENCODER MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

10. GLOBAL AUTONOMOUS VEHICLE SENSOR MARKET BY COMPONENT 2014-2023 ($ MILLION)

11. GLOBAL CAPACITIVE MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

12. GLOBAL INDUCTIVE MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

13. GLOBAL MAGNETIC MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

14. GLOBAL OPTICAL MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

15. GLOBAL PIEZOELECTRIC MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

16. GLOBAL AUTONOMOUS VEHICLE SENSOR MARKET BY APPLICATION 2014-2023 ($ MILLION)

17. GLOBAL CHASSIS MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

18. GLOBAL ENGINE MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

19. GLOBAL FUEL INJECTION AND EMISSION MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

20. GLOBAL POWER TRAIN MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

21. GLOBAL SAFETY AND CONTROL MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

22. GLOBAL TELEMATICS MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

23. GLOBAL VEHICLE SECURITY MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

24. GLOBAL OTHERS MARKET BY GEOGRAPHY 2014-2023 ($ MILLION)

25. NORTH AMERICA AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

26. EUROPE AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

27. ASIA PACIFIC AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

28. REST OF THE WORLD AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

LIST OF FIGURES

1. GLOBAL AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

2. GLOBAL CAMERA MODULE SENSOR MARKET 2014-2023 ($ MILLION)

3. GLOBAL DIGITALLY CONTROLLED BRAKE, THROTTLE, STEERING SENSOR MARKET 2014-2023 ($ MILLION)

4. GLOBAL GPS RECEIVER MARKET 2014-2023 ($ MILLION)

5. GLOBAL IMU SENSOR MARKET 2014-2023 ($ MILLION)

6. GLOBAL LIDAR SENSOR MARKET 2014-2023 ($ MILLION)

7. GLOBAL RADAR SENSOR MARKET 2014-2023 ($ MILLION)

8. GLOBAL ULTRASONIC SENSOR MARKET 2014-2023 ($ MILLION)

9. GLOBAL WHEEL ENCODER MARKET 2014-2023 ($ MILLION)

10. GLOBAL CAPACITIVE MARKET 2014-2023 ($ MILLION)

11. GLOBAL INDUCTIVE MARKET 2014-2023 ($ MILLION)

12. GLOBAL MAGNETIC MARKET 2014-2023 ($ MILLION)

13. GLOBAL OPTICAL MARKET 2014-2023 ($ MILLION)

14. GLOBAL PIEZOELECTRIC MARKET 2014-2023 ($ MILLION)

15. GLOBAL CHASSIS MARKET 2014-2023 ($ MILLION)

16. GLOBAL ENGINE MARKET 2014-2023 ($ MILLION)

17. GLOBAL FUEL INJECTION AND EMISSION MARKET 2014-2023 ($ MILLION)

18. GLOBAL POWER TRAIN MARKET 2014-2023 ($ MILLION)

19. GLOBAL SAFETY AND CONTROL MARKET 2014-2023 ($ MILLION)

20. GLOBAL TELEMATICS MARKET 2014-2023 ($ MILLION)

21. GLOBAL VEHICLE SECURITY MARKET 2014-2023 ($ MILLION)

22. GLOBAL OTHERS MARKET 2014-2023 ($ MILLION)

23. UNITED STATES (U.S.) AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

24. CANADA AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

25. UNITED KINGDOM (UK) AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

26. FRANCE AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

27. GERMANY AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

28. SPAIN AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

29. ROE AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

30. INDIA AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

31. CHINA AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

32. JAPAN AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

33. AUSTRALIA AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

34. ROAPAC AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

35. LATIN AMERICA AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)

36. MENA AUTONOMOUS VEHICLE SENSOR MARKET 2014-2023 ($ MILLION)